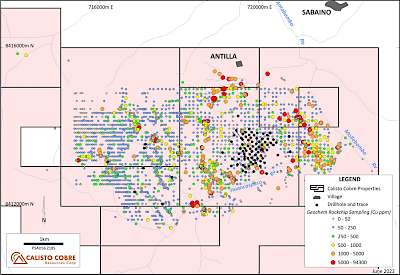

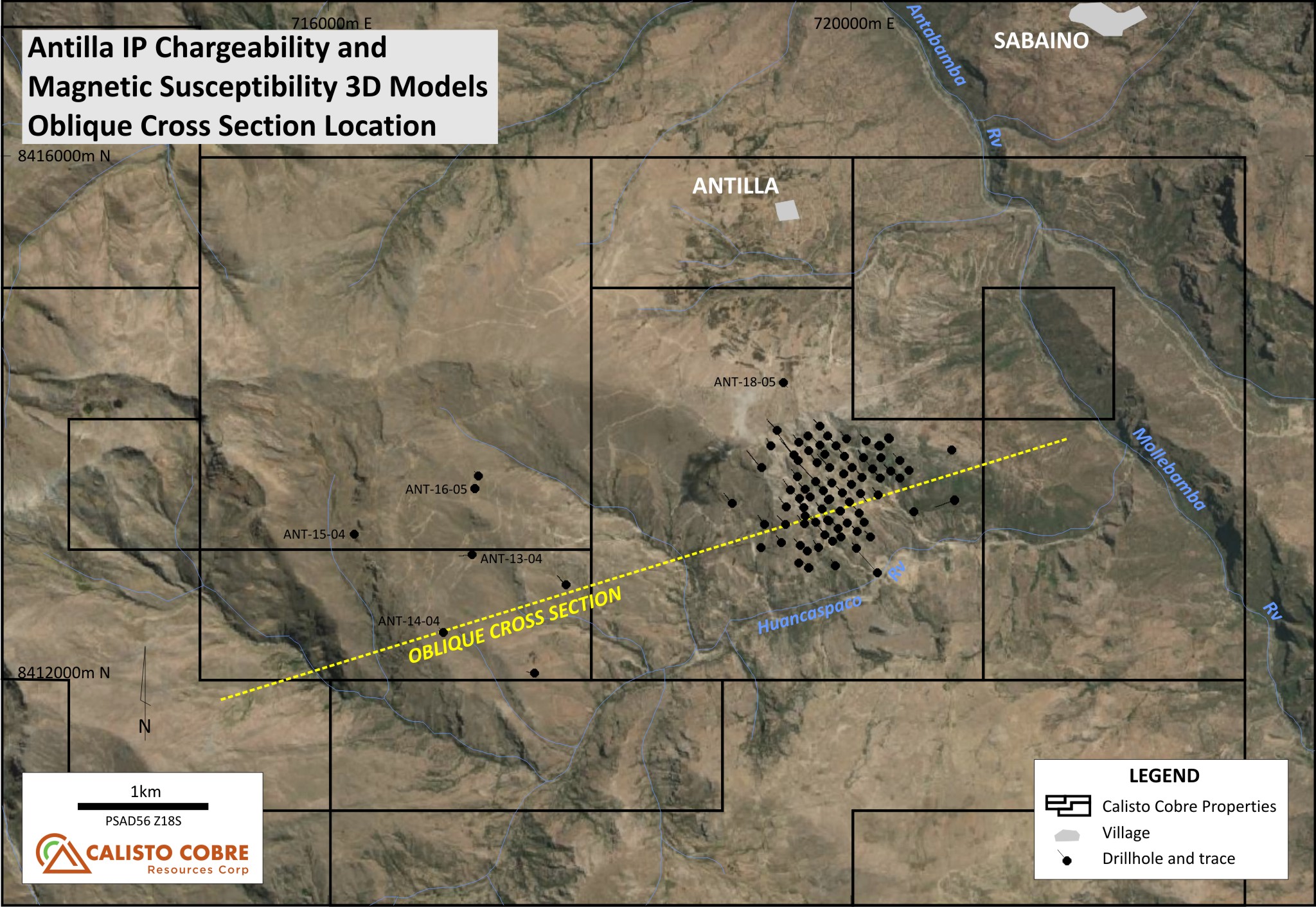

Calisto Cobre's flagship property is the Antilla Copper Project ("Property" or "Project"), in the Apurimac Region of southern Perú – an active mining region of the country – situated approximately 8 hours by road southwest of Cusco. The Property consists of 12 exploration concessions covering approximately 7,500 hectares, and hosts existing Indicated Resources of 2.2 billion pounds of copper and Inferred Resources of 0.4 billion pounds of copper. Calisto Cobre considers the Property to be substantially under-explored, with the main porphyry intrusion(s) driving mineralization yet to be discovered.

Calisto Cobre's flagship property is the Antilla Copper Project ("Property" or "Project"), in the Apurimac Region of southern Perú – an active mining region of the country – situated approximately 8 hours by road southwest of Cusco. The Property consists of 12 exploration concessions covering approximately 7,500 hectares, and hosts existing Indicated Resources of 2.2 billion pounds of copper and Inferred Resources of 0.4 billion pounds of copper. Calisto Cobre considers the Property to be substantially under-explored, with the main porphyry intrusion(s) driving mineralization yet to be discovered.

In December 2021, the Company purchased a 75% operating interest in the Project from Panoro Minerals Ltd. ("Panoro"), and has the ability to increase its interest to 90% by making certain additional payments to Panoro. The concessions are held free of outstanding liens or encumbrances, with the exception of a 2% net smelter return royalty ("NSR") granted in favor of Panoro.

The Property is located approximately 330 km from Cusco, traveling mainly along paved roads. There are regular scheduled flights from Lima to Cusco. The Property is located approximately 140 km by road from Abancay, capital of the Apurimac Region, where most supplies may be sourced, and adjacent to the village of Antilla.

The Property is located approximately 330 km from Cusco, traveling mainly along paved roads. There are regular scheduled flights from Lima to Cusco. The Property is located approximately 140 km by road from Abancay, capital of the Apurimac Region, where most supplies may be sourced, and adjacent to the village of Antilla.

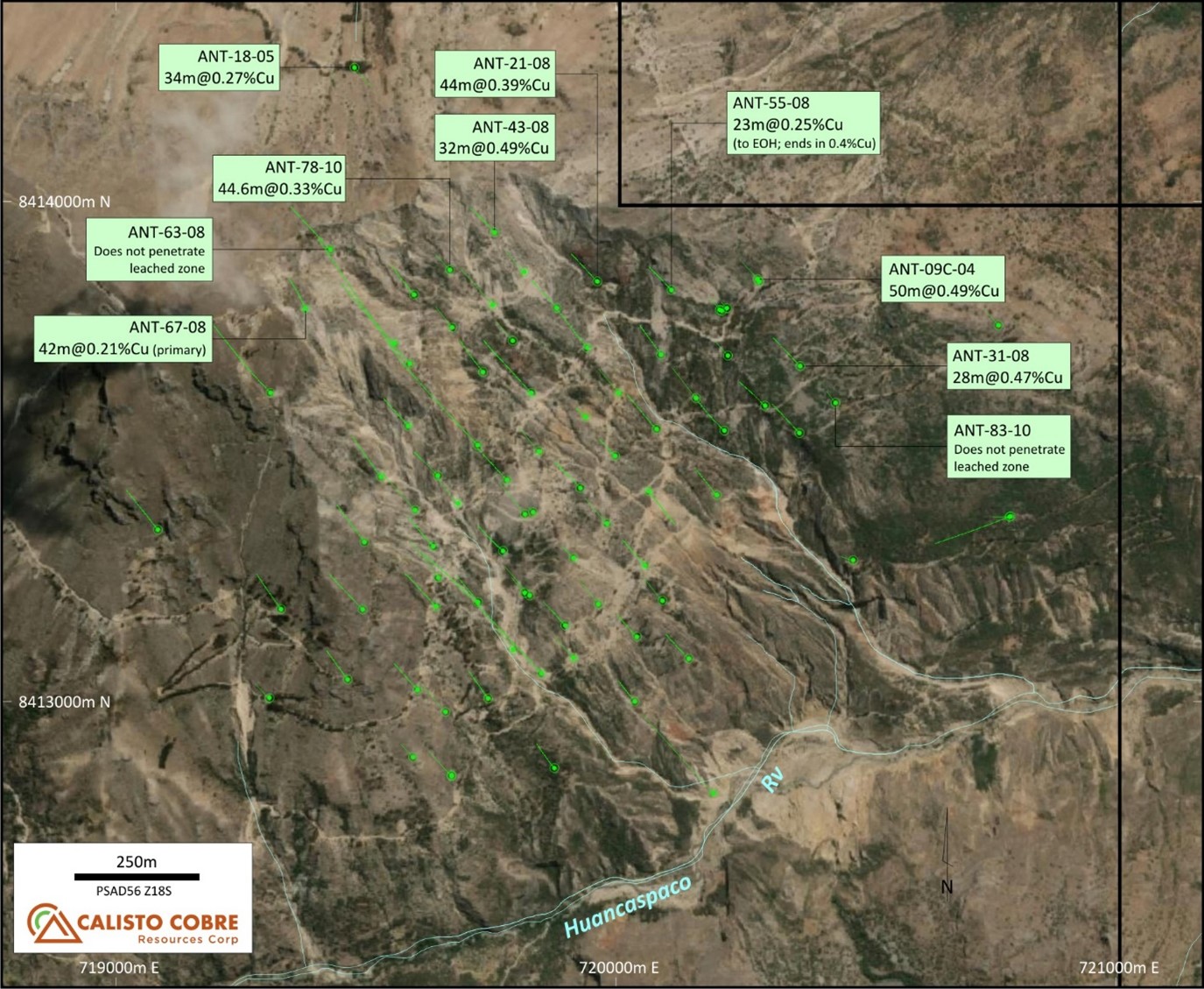

Climate in the region of the Property is characterized by dry winters and rainy summer seasons. Project elevations in its high Andean Cordillera location vary between 2,500 meters to 4,500 meters above sea level ("masl"). Relief on the Property varies from moderate slopes to very high rugged relief along the flanks, and tops, of the ridges.